Business Insurance in and around Roanoke

Get your Roanoke business covered, right here!

No funny business here

Cost Effective Insurance For Your Business.

Do you own a flower shop, a dance school or a cosmetic store? You're in the right place! Finding the right protection for you shouldn't be risky business so you can focus on what matters most.

Get your Roanoke business covered, right here!

No funny business here

Insurance Designed For Small Business

Your business thrives off your tenacity commitment, and having reliable coverage with State Farm. While you support your customers and do what you love, let State Farm do their part in supporting you with artisan and service contractors policies, commercial liability umbrella policies and commercial auto policies.

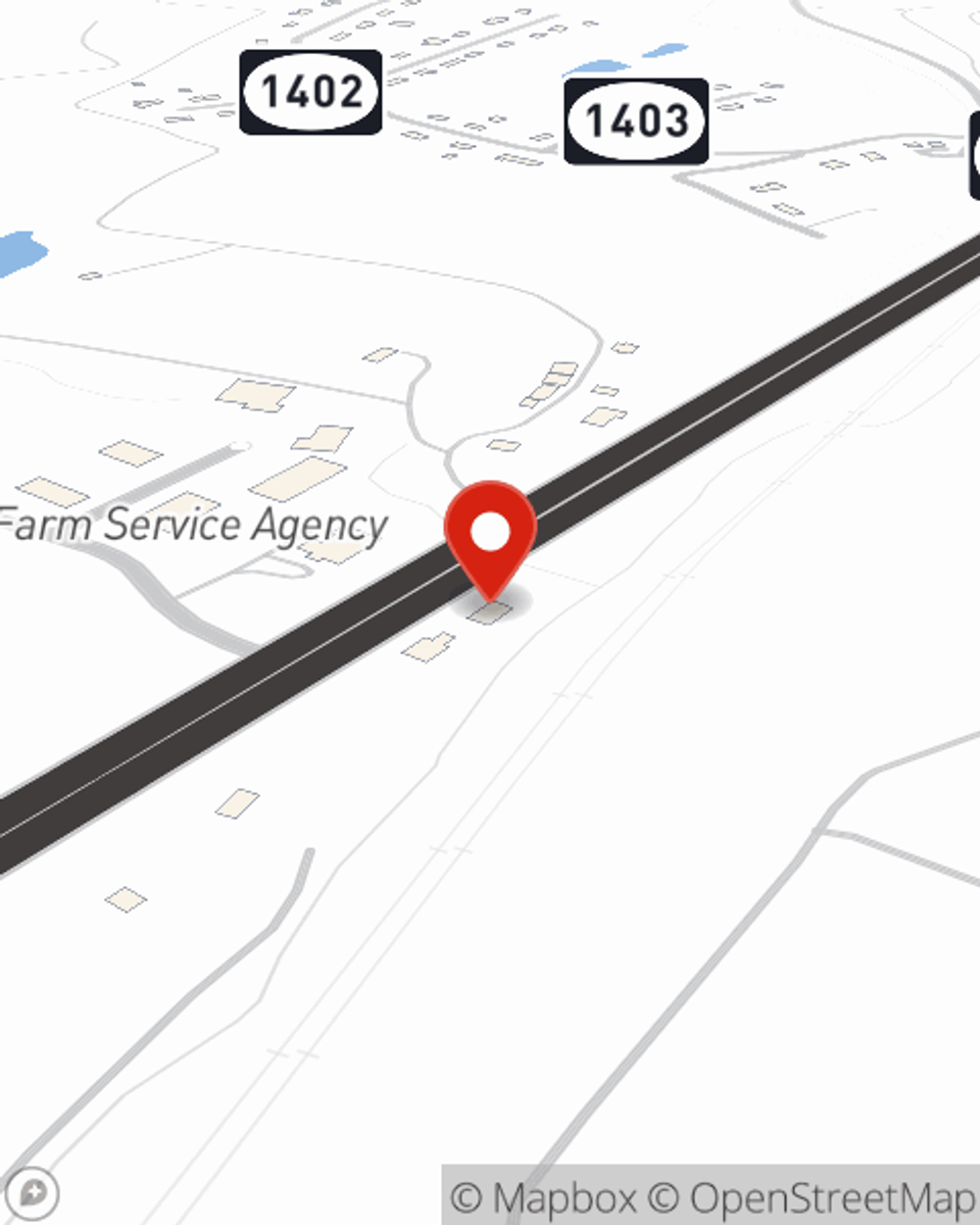

Since 1935, State Farm has helped small businesses manage risk. Contact agent Todd Selkirk's team to identify the options specifically available to you!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Todd Selkirk

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.